Scaled, serial acquirers in the enterprise software world are wonderful businesses to invest in for the long-term. Everyone knows about the margin structure of software businesses and recurring revenue characteristics. Owning equity in a software holding company diversifies away much of the idiosyncratic individual portfolio company risk and provides a long-term durable stream of cash flows. In many ways, you can compare this to a diversified REIT given the contracted, diversified cash flow streams across a collection of assets. These businesses can act both acyclical and counter-cyclical. These businesses are not of the get rich fast variety. They require a combination of patient investor capital and serious operators with consistent discipline.

I had always wanted to find a team to back early on in their software holding company ascent. I found the opportunity in 2019 after reading a newspaper article about a team in San Antonio, Texas in its infancy.

I met the Dura team in early 2019 when the company was the three co-founders, Chris, Paul and Michael and their new corporate development hire, Conor. They owned one business at the time, Moki Software, which they acquired with their own capital. They also possessed a bold vision for how they would acquire and operate a portfolio of businesses and had developed a strong pipeline of acquisition targets. It was an easy decision to invest for the following reasons:

First, the founding team had strong operating experience developed primarily at Dell, EY and Rackspace. They knew that buying slower growth software businesses required strong focus on customer service and sales.

Second, back when I was a public market investor I had spent years studying serial acquisition business models across industries on the long and the short side. When they worked, they worked in a big way, but I had never had the opportunity invest in one early enough to catch the whole growth wave. Many know the biggest success stories: Constellation Software, Danaher Corporation, Rollins Corporation, Roper Technologies, Transdigm, Vitec Software and others. As a publicly traded software serial acquirer, Constellation has gone up over 100x since 2006. Others like Descartes and Open Text have generated greater than 20x returns in the public markets. Several lesser known, private software holding companies are multi billion-dollar enterprise value businesses and have birthed billion dollar fortunes.

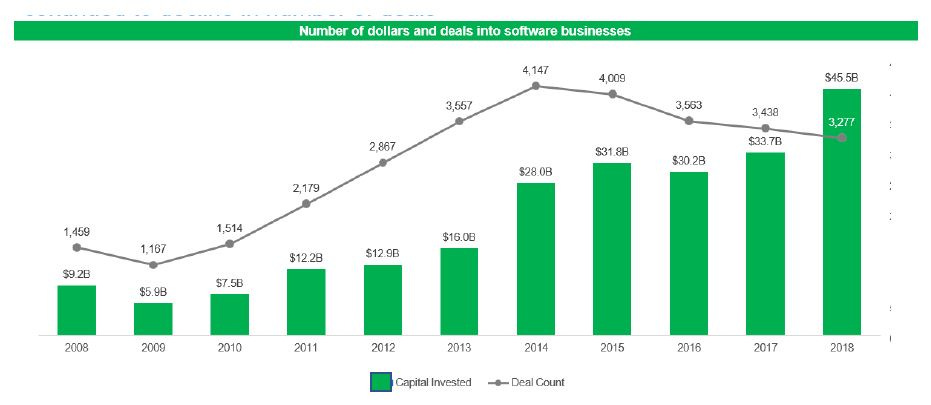

Third, the acquisition TAM is massive and expanding due to the rapid pace of new software business creation. Dura has more than 70,000 companies in its target database out of a universe of an estimated 175,000 software vendors. In the three years preceding my initial investment, an average of 3,400+/year software companies received venture funding.

How many of those logically will be venture exits? By my math, Dura would only have to make a few acquisitions per year over a 10 year period for this to be a great return for my investors.

Fourth, Texas is a great place to build the business. Texas provides a large and talented labor pool, is lower cost compared to gateway coastal cities and has a great time zone for global corporate development outreach. San Antonio specifically has a large labor force accustomed to an extreme focus on customer success. Texas also acts as a gateway to Latin America, where talented human capital can be accessed easily. Check that box.

Lastly, the Dura team had discipline around underwriting acquisitions and operating playbooks to execute on their underwriting. All prospective Dura investments had to meet hurdles comparable to that of top-decile private equity funds. Dura is underwriting these returns with only modest growth assumptions and a permanent hold model. The goal is to operate each business with Rule of 40 metrics. With a high reinvestment rate and high returns on capital, this business can get big very reliably.

Fast forward to now. Dura has hundreds of employees, many of them based at their HQ in San Antonio, Texas. Revenue is up over 20x. The corporate development engine is humming, as the compounding effects of thousands of calls and emails has bolstered Dura’s brand with Sellers, bankers, brokers and intermediaries in the acquisition market. From first contact to close, investments in this space can take years. The efforts of 2018-2021 will bear fruit in 2022-2025.

Dura owns ten businesses acquired at fair prices and was named one of the fastest growing companies in Central Texas. It’s still in the early innings.

Dura has done all of this with the headwinds of frothy private and public market valuations and a delusional market, all while only raising around $20m in outside equity.

Where does Dura stand now on the acquisition front?

In control acquisitions when you deploy capital can have just as big of an impact on investment success as what you deploy your capital into. It goes against much of conventional finance speak, but I firmly believe market timing is important. This will become even more apparent as we endure through a more volatile macro environment.

Admittedly, acquiring software companies at fair to value-oriented prices have been challenging to pull off over the past few years. When times are good, there are always situational sellers: retiring owners, tired corporate owners divesting a subsidiary or a private equity/venture capital firm looking to sell the last remaining asset in a legacy fund. Each acquisition requires hundreds to thousands of stones to be turned over.

When times are bad, the quantity and variety of sellers increases, and they are way more motivated. You also have lenders looking to recover asset value from their loan books, bankruptcies and owners who want to sell rather than navigate a challenging operating environment for another few years. Additionally, as many of you know, so much venture capital has gone into software businesses. Many of this capital was invested recklessly into companies slamming into a growth wall. Many of the recipients of that capital do not understand how to run a business for cash flow rather than hyper growth because they have only operated in a low interest rate, easy money regime. Many of these businesses will need a company like Dura to rescue them and allow legacy founders to move onto their next hyper-growth adventure. Time for a cleanup on Aisle 6.

Dura’s team is laser focused on executing during this market downturn. This is the best environment to acquire businesses that Dura has seen since its founding. The pipeline is swelling. Dura did a fantastic job executing in an up-market and I’d expect the next few years to be some of the best. I was excited to invest in the team in 2019, and again in 2021 and will do so again in the future. My guess is that ten years from now, we will be wishing for more years like the dog days of 2022-whenever this current malaise ends. It’s clearly go time.

-Matt

This essay contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended (the “Securities Act”). Such statements are based upon current expectations that involve risks and uncertainties. Any statements that are not of historical fact, may be forward-looking statements. The words “anticipates,” “believes,” “continues,” “designed,” “estimates,” “expects,” “goal,” “intends,” “leverage,” “likely,” “may,” “ongoing,” “path,” “plans,” “projects,” “pursuing,” “seeks,” “should,” “will,” “would” and similar expressions (including the negatives thereof) are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The plans, intentions, expectations or objectives disclosed in our forward-looking statements may not be achieved, and the assumptions underlying our forward-looking statements may prove incorrect. Therefore, you should not place undue reliance on our forward-looking statements. Actual results or events may differ significantly from the results discussed in the forward-looking statements we make. All forward-looking statements in this essay are based on information available to us as of the date of its initial publication, and we assume no obligation to update any such forward-looking statements.

Hey Matt,

Thanks for distilling some crystal clear thinking around this thesis. I'm all in on it.

If you're looking to do it all over again check us out (xo.capital). We've bought 6, sold 1, currently operate 5.

Love it! I’m a huge believer in this thesis. Thanks for sharing your insights.